What is ARV? When you’re hosting sweepstakes, it’s important the value of the prize because there are different laws that apply based on the retail value of the prize.

In this article, we’ll discuss what ARV is and how to determine its value. We’ll also go over the difference between ARV and FMV, and talk about tax implications for prizes.

What is ARV?

ARV stands for approximate retail value. It’s what the prize is worth if someone were to buy it at retail price. This is important to know because it helps you set the fair market value of the prize(s) in your contest or sweepstakes.

If you’re giving away a trip, for example, you’ll need to know the ARV before you can determine what the prize is worth. It’s important to note you must share what the value includes for trip giveaways. This means communicating to your audience what are all the elements included in the trip prize. Is it hotel stay only or is it hotel and flights from A, B, and C destinations? Does it include ground transportation? Gratuities? Cash stipends?

How Do You Determine ARV?

There are a few different ways to do this.

First, you can look up the retail price of the item online and compare them to what you see in retail. Be mindful that prices listed online may be lower than products in retail due to retail’s added business costs. If you’re giving away a trip, you can search for similar trips and get an idea of what they cost. You can also ask an expert in the field to help you determine the ARV of your prize.

Cost vs Retail Value

Sponsors calculate the ARV based on the average retail value the product or service has in the market at the time of the sweepstakes offer.

The ARV should be based upon the actual amount the winner would pay if they purchased the prize themselves. If you are awarding a TV selling at retail for $1,000, you would disclose an ARV of $1,000, not the cost you paid.).

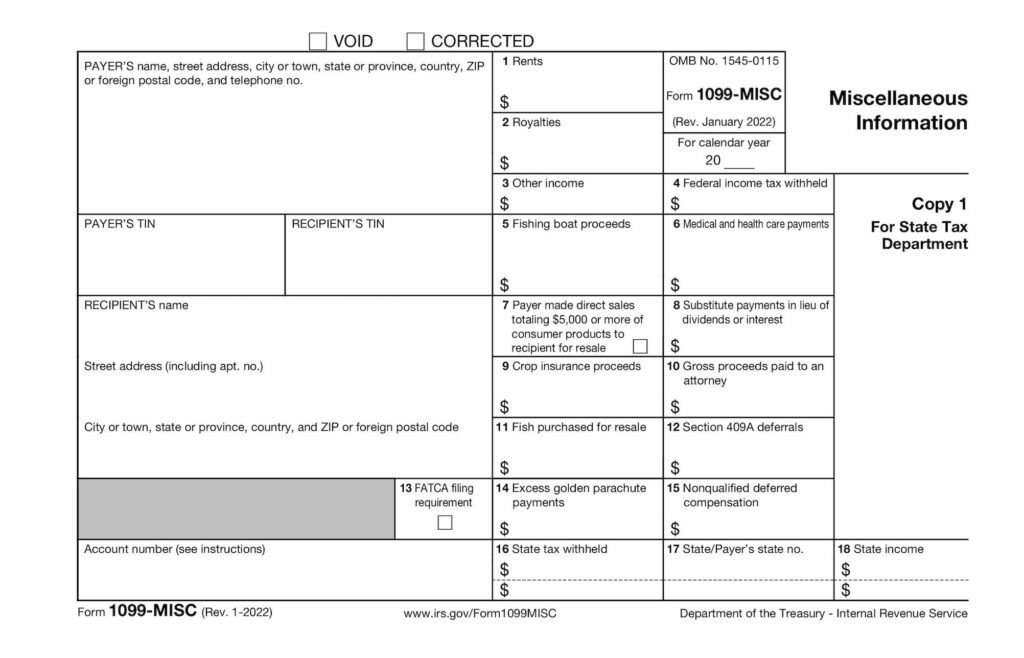

Tax Implications

If you’re giving away a prize worth more than $600, you will need to file a 1099 MISC tax form with the IRS and send the winner(s) a copy. This is because for prizes won above $600 in ARV, the IRS requires 1099 MISC tax reporting.

In some jurisdictions, your sweepstakes may need to be licensed and bonded. If the total ARV of the prize(s) offered exceeds $5,000 and the sweepstakes is offered to New York or Florida residents, companies must register and bond their sweepstakes in those states.

In Rhode Island, there is no bonding requirement, however, if the prize is worth $500 or more and if the sweepstakes Sponsor operates a brick and mortar business in RI with promotions taking place inside of a retail location, there is a registration requirement.

Conclusion

Stay ahead of the game by including your overall prizes ARV in your sweepstakes Official Rules.

A sweepstakes administrator like Sweeppea can assist you with any registration or bonding requirements that may come up, as well as help you determine the ARV of the prize(s) of your promotion.

Need help with sweepstakes or contest management? Call 305-505-5393 or email us with your questions.